On May 28, 2024, the "Focus on 'New Credit' - China Chengxin International 2024 Mid-year Credit Risk Outlook and Investor Service Summit" hosted by China Chengxin International was successfully concluded in Beijing. Analysts and market investment institution representatives of China Chengxin International shared their professional views on macroeconomic trends, financial services for the real economy, industrial transformation of urban investment companies, credit risks in the fixed income market and ESG development trends at the meeting. The China Chengxin QE rating system and FITS 2.0 products were also launched at the meeting. As one of the important annual seminars and market brand activities of China Chengxin International, this summit attracted representatives and investors from major industrial and commercial enterprises, financial institutions, professional research institutions, and news media at home and abroad. The morning session of the meeting was hosted by Deng Dawei, Chief Information Officer of China Chengxin International .

Yue Zhigang, President of China Chengxin International, said in his speech that the current internal and external environment of China's economic development is complex and changeable, and credit risks are showing new characteristics. In order to better adapt to the new situation, implement new requirements, and develop new products, the rating industry needs to focus on "new credit", strive to change the traditional rating concept, optimize the rating method system, and innovate business products and services. This conference is based on three "new", namely "new situation", "new requirements" and "new products", and focuses on the theme of "new credit" for in-depth discussion. He said that considering the impact of favorable factors and drag factors on economic growth, the favorable factors supporting the stable operation of the economy will still play a role in the next few quarters, and the judgment that China's economic growth rate will be around 5% in 2024 is still maintained.

Yue Zhigang, President of China Chengxin International

Deng Dawei, Chief Information Officer of China Credit International

Yan Yan, Chairman of CCXI, delivered a keynote speech at the meeting titled "China's Economy under the Coexistence of Accelerated Growth and Imbalanced Supply and Demand." Yan Yan pointed out that this year's macro-economy has had a stable start and accelerated growth. Industrial production and manufacturing investment have accelerated significantly. Marginal improvements in exports have also played a driving role in external demand. The overall economic operation has shown a positive trend. However, it should also be noted that the acceleration of production has caused a certain misalignment with the weakening of terminal consumption, weak price levels, and sluggish financing demand. The imbalance between supply and demand has not been significantly alleviated, and has even deepened. Against this background, the role of economic policy in stabilizing economic growth and alleviating structural contradictions will be further highlighted. From the current point of view, with the support of the accelerated implementation of fiscal policies, the continued promotion of equipment renewal and trade-in policies, and the intensive introduction of new real estate policies, China's stable and positive economic situation is expected to be further consolidated.

Yan Yan, Chairman of China Chengxin International

In the following roundtable discussion on "Moving towards the "new", financial empowerment of the real economy - transformation and challenges", Wang Yafang, director of financial institution ratings of China Chengxin International, Shi Man, deputy director of corporate ratings of China Chengxin International, Jiang Teng, chief analyst of corporate rating department , and Fei Teng and Zhang Yunpeng, chief analysts of financial institution department, discussed. This year's "Government Work Report" proposed to vigorously promote the construction of a modern industrial system and accelerate the development of new quality productivity. Cultivating new quality productivity has become a hot word in the current economic society. The roundtable speakers first elaborated on the basic elements of new quality productivity in terms of innovation, advancement, and quality, and explained from the perspective of policy support that the national financial regulatory authorities guide financial institutions to implement the fundamental purpose of financial services to the real economy and empower the development of new quality productivity. The speakers introduced the credit trends of new energy vehicles, photovoltaic manufacturing, electronic manufacturing and information technology, pharmaceutical manufacturing and other industries under the background of new quality productivity factors and financial empowerment, and introduced the "Technology Innovation Enterprise Rating Methods and Models" recently released by China Chengxin International.

Roundtable discussion on "Moving towards the "new", financial empowerment of the real economy - transformation and challenges"

In the roundtable discussion of "Promoting Transformation and Seeking Development - How to View the Industrialization Transformation of Urban Investment and Investment under the Background of a Package of Debt Reduction", Wei Yun, Director of Government Public Ratings of China Chengxin International, Yuan Haixia, Executive Director of China Chengxin International Research Institute, Yang Xiaojing, Deputy Director of Government Public Ratings, and Zhang Min and Zhu Jie, Chief Analysts of the Government Public Rating Department, discussed. In the context of controlling growth and reducing stock, coordinating debt reduction and development, the transformation of urban investment and investment enterprises needs to effectively drive the stable development of the local economy while truly reducing debt; in the medium and long term, transformation is a necessary measure for the high-quality development of enterprises. On this basis, the speakers discussed the core elements that urban investment and investment enterprises should have in their transformation and the differences in importance and urgency of this round of debt reduction and transformation from the past. In addition, due to the different resource endowments of various regions, the difficulty of dealing with the balance between debt reduction and development varies, and various regions also show great differences in transformation practices. Finally, the guests shared how to dynamically evaluate the credit risk of urban investment and investment enterprises in the context of a package of debt reduction .

Roundtable discussion on "Promoting transformation and seeking development - how to view the industrialization transformation of urban investment in the context of a package of debt repayments"

afternoon session of the meeting focused on investor services and ESG in the fixed income market, and was hosted by Xue Dongyang, Chief Human Resources Officer of China Chengxin International and President of China Chengxin Green Finance.

Xue Dongyang, Chief Human Resources Officer of China Chengxin International and President of China Chengxin Green Finance

credit rating director of China Chengxin Analysis , and Liang Shun, vice president of China Chengxin Analysis, respectively released the China Chengxin QE rating system and FITS2.0 product.

Cao Run, Director of Credit Ratings at China Credit Rating

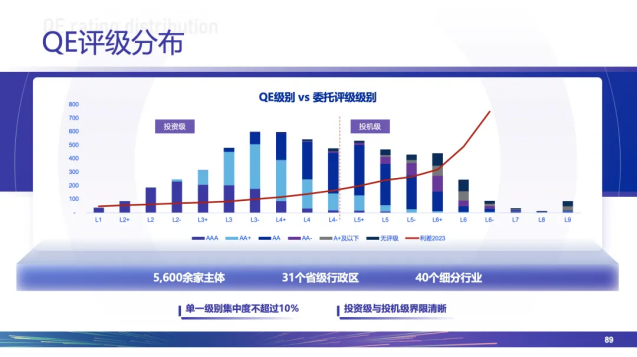

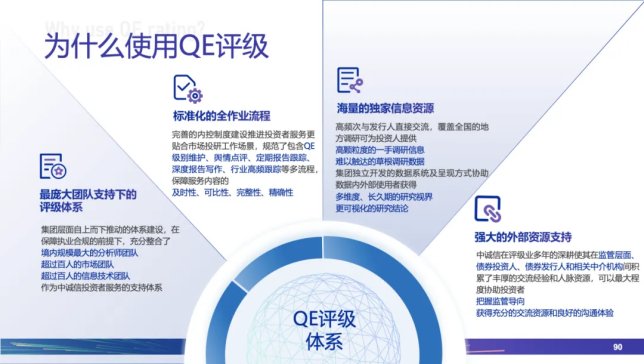

QE rating is a credit rating based on "default probability measurement". The "Q" ( Quantitive Model) and "E" (Expert based) in its name represent quantitative models and expert judgments, respectively, which are also the core of this credit rating system. QE rating starts from the perspective of investors in the fixed income market and provides an independent, objective and reasonably differentiated credit rating scale for the fixed income market; relying on a standardized, scientific and complete credit rating system, it creates a complete investor service ecosystem and helps promote the improvement of the credit rating environment in the entire market.

QE Rating VS Delegated Rating Level

QE Rating Advantages

FITS products rely on the credit risk management technology and professional talent team accumulated over the years, integrate industry data, regional data, subject data, bond data, credit default data, credit public opinion data and other credit big data, use advanced credit risk modeling technology, and supplemented by AI, machine learning, big data computing and other technical means to create a complete set of credit risk management system solutions for credit bonds, ABS, and non-standard credit assets for users. It fully covers credit data governance services, credit modeling services, system development services, supporting risk investigation, etc., so that users can truly purchase services once to cover all needs.

Liang Shun, Vice President of China Credit Analysis

FITS main modules

During the early R&D and testing of the products, the QE rating system and FITS2.0 products were highly recognized by investment institutions. A procurement signing ceremony was held between China Credit Rating Analysis and various institutions at the meeting.

In the roundtable discussion session on "Investment and Risk Control Strategies in the Era of Big Asset Management", Hou Yanjie, deputy general manager and research director of the fixed income department of Minmetals Trust, Zhang Ting, director of the fixed income research department of Minsheng Bank, and general manager of the investment research department of Caida Securities Xu Wenyong, Deputy General Manager of the Fixed Income Department of CICC Xu Haomiao, Managing Director of Langzi Asiana Investment and Securities Department Chen Benyang , and Investment Director of Yikun Private Equity Mou Chong started the discussion. They analyzed how to tap investment returns in the context of the "asset shortage" caused by the imbalance in the supply and demand of credit bonds, and discussed how to view the current situation of large-scale non-standard urban investment risks and the compression of the standard bond spread mechanism, injecting investment into this conference Great content from a human perspective.

"Investment and Risk Control Strategies in the Era of Big Asset Management" Roundtable Discussion

Wang Shuling, deputy director of the ESG Solutions Department of CCX Green Finance, published a report titled "ESG Rating Performance of Sample Enterprises Mandatory Disclosure by the Three Major Exchanges". She shared the content framework and significance of the "Sustainable Development Report (Trial)" guidelines, and analyzed the ESG information disclosure and ESG rating performance of sample enterprises.

Wang Shuling, Deputy Director of ESG Solutions Department, CCX Green Gold

Zhang Yingjie, Vice President of China Chengxin Green Finance, delivered a keynote speech entitled " Practicing ESG Concepts and Improving ESG Rating Performance". He elaborated on the current status of ESG development at home and abroad, ESG rating methods and rating performance, ESG rating practice and application, etc. He said that Chinese ESG rating agencies are actively exploring the layout of international market business, gradually establishing information disclosure standards and ESG rating systems in line with the international market, participating in international competition, effectively improving rating quality, enhancing the ability to serve international investors, and cultivating ESG rating agencies with international influence.

Zhang Yingjie, Vice President of CCX Green Finance

Wang Qian, President of CCX Green Finance International, delivered a keynote speech entitled "International Standards Promote ESG Development in Offshore Markets". She elaborated on the ESG development of offshore markets, the application of international standards in offshore markets, and the business practices of Chinese companies in the field of international standards. CCX Green Finance International is the first Chinese rating agency approved by the Hong Kong Monetary Authority for the Green and Sustainable Finance Funding Program. It actively deploys green finance and ESG markets in Hong Kong and overseas, helping companies achieve high-quality sustainable development.

Wang Qian, President of CCX Green Finance International

In the roundtable discussion of "ESG Development Trends and Business Practices", Zhang Yingjie, Vice President of China Chengxin Green GoldFinance, Li Wenjie, Vice President of Suzhou Industrial Park Urban Development Research Institute, Li Fei , CDP Global Co-Disclosure Director, Zheng Cuiying, Head of Jiemian News ESG Channel, and Zhou Meiling, Director of ESG Solutions Department of China Chengxin Green Finance, discussed the business development path in the ESG field in terms of data, information disclosure, rating, certification and consulting services from the perspectives of ESG policies and market development trends and corporate ESG performance.

Roundtable discussion on "ESG development trends and business practices"