On November 6, the Shanghai and Shenzhen Stock Exchanges simultaneously issued the “Self-Regulatory Guidelines for Listed Companies - Preparation of Sustainability Reports” (hereinafter referred to as the “Guidelines”), which will be open for public consultation until November 21, with a view to forming suitable China's more comprehensive and systematized norms for sustainability disclosure. As a supporting document of the “Self-Regulatory Guidelines for Listed Companies - Sustainability Reporting (for Trial Implementation)” (hereinafter referred to as the “Guidelines”), the Guidelines analyze the relevant requirements of the Guidelines in detail, and provide effective guidance for listed companies to better understand and carry out the disclosure of sustainability reports. The Guidelines provide a detailed analysis of the relevant requirements of the Guidelines, providing effective guidance for listed companies to better understand and carry out disclosure of sustainability reports.

The Guidelines include two specific guidelines on “General Requirements and Disclosure Framework” and “Responding to Climate Change”, which are applicable to companies listed on the Main Board, the Technology and Innovation Board (TIB), the Growth Enterprise Market (GEM) and the Bejing Stock Exchange (BSE). The Guide specifies key tips and examples for disclosure of sustainability reports, explains important concepts and clarifies implementation steps to promote listed companies to enhance their awareness of sustainability and continuously optimize their sustainability management.

Interpretation of the guidance on General Requirements and Disclosure Framework

The General Requirements of the Guidelines continue and analyze the requirements of the Guidelines of the exchanges, and emphasize that the sustainability report should be published in the form of independent report.

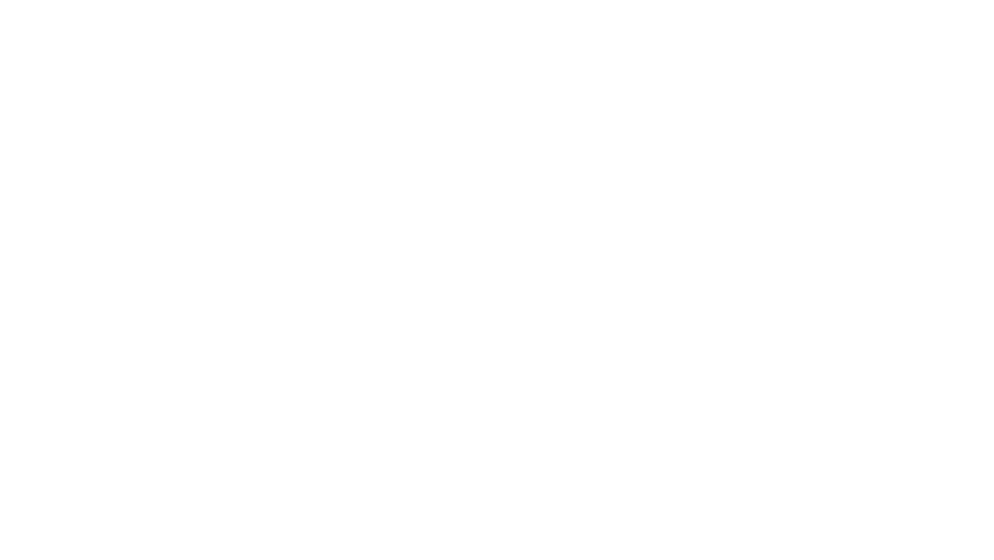

The “General Requirements and Disclosure Framework” guide specifies the subject of disclosure of the sustainability report, the form of disclosure of dual materiality issues, and refines the process of analyzing the materiality of the issues, the factors for assessing the financial/influential materiality and the thresholds for judging, so as to provide support and reference for listed companies to reasonably carry out the assessment of the materiality of the issues.

In terms of materiality assessment, listed companies are required to assess the materiality of the 21 issues stipulated in the Guidelines, and conduct their own identification and assessment in light of the company's situation. Issues identified as financially material need to be disclosed in accordance with the four elements of “Governance - Strategy - Impact, Risk and Opportunity Management - Indicators and Targets”.

The “General Requirements and Disclosure Framework” guide greatly expands the explanations and sample references of the four elements, clarifies the specific steps and measures that companies can take, and provides a lot of inspiration on how to integrate with the existing governance structure and employee responsibilities, the construction of internal reporting and monitoring mechanisms, and the establishment of management objectives and indicators, providing Chinese listed companies with specific and clear management measures and practices, so that the content of sustainability reports can be guided by rules and regulations and be based on evidence to promote governance and enhance the level of ESG governance and the ability of sustainable development of listed companies in China. The content of the sustainability report can be followed and documented, promoting governance through disclosure and enhancing the ESG governance level and sustainable development capability of listed companies in China.

The last chapter of the “General Requirements and Disclosure Framework” guide provides listed companies with a referable framework for sustainability reporting. The report needs to take material issues as the main chapters, and for the issues with financial materiality, the four elements are used as the disclosure method, and each issue is required to be disclosed in accordance with the framework of the four elements, and the “governance” part of the four elements can be integrated and disclosed in the report. The General Requirements and Disclosure Framework guide provides a reference disclosure framework for the specific content of the four elements, which will help companies to quickly understand and be able to quickly carry out work related to sustainable development.

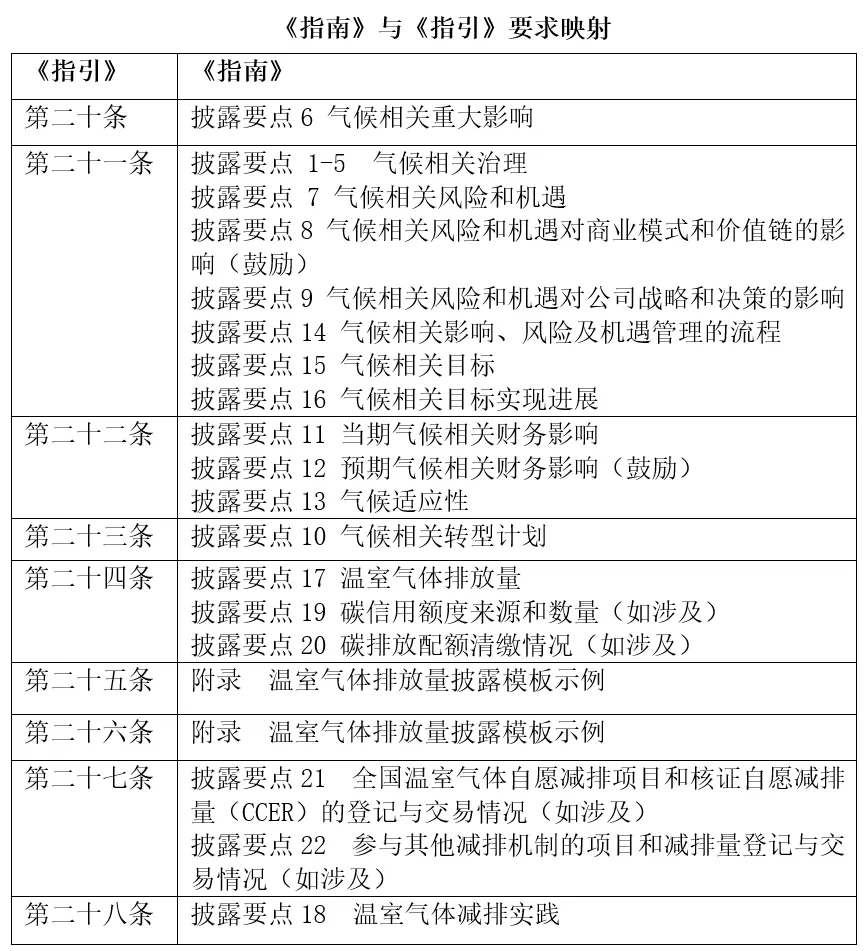

Interpretation of the Guidelines for Responding to Climate Change

The second part of the Guidelines is a guide on “Responding to Climate Change”, which corresponds to the topic of “Responding to Climate Change” under the environmental dimension of the Guidelines. The three exchanges indicated that they will accelerate the development of specific guides on other important topics according to market needs under the coordination of the SFC, so as to gradually realize the full coverage of the key contents of the Guidelines.

Against the backdrop of the global development of a low-carbon transition economy, many countries and companies have proposed carbon neutral targets and formulated carbon reduction/transformation plans to constrain and manage their carbon emissions. China's dual-carbon target is proposed to promote the whole society and industry to reduce energy consumption, improve energy efficiency and guide the development of green transformation. The disclosure of energy consumption, greenhouse gas emissions and other relevant information by listed companies can actively drive the entire value chain to reduce carbon emissions and play a leading role in benchmarking the industry.

In addition, physical risks and transformation risks brought by climate change will eventually be transformed into financial risks, or the company has explored new opportunities in strategic transformation and business models to adapt to climate change. Climate-related risks and opportunities may affect the company's current and future financial position, operating results and cash flow, and the actual and potential financial impacts are significant to the capital market.

The Responding to Climate Change guidance fully extends the requirements of the Guidelines, drawing on the specifics of the International Sustainability Standards Board's (ISSB's) International Financial Reporting Standard S2 - Climate-Related Disclosures, and combining the guidance with the actual conditions of China's market, such as Certified Voluntary Emission Reductions (CCERs) and Carbon P&L.

concluding remarks

The release of the Guidelines provides listed companies with a complete set of tools and methods for sustainability work, assists listed companies in improving their sustainability governance structure and workflow, and provides effective methods and references for materiality issue assessment, and identification of sustainability-related risks and opportunities. In addition, the Guide refines the disclosure requirements in the Guidelines into specific disclosure points and explanatory notes, providing convenience for the preparation of sustainability reports by listed companies.

The time has come for China to take the lead in initiating the standardized compilation of sustainability reports by listed companies, which will accumulate rich exploratory experience and excellent practice cases for the disclosure of sustainability information by domestic enterprises. The release of the Guide will better serve listed companies in responding to the demands of various stakeholders, and lead China's enterprises and economy into a new stage of high-quality development with the disclosure of sustainability reports as a starting point.

Author: Li Yue

Audit: Zhou Meiling