On 6 November 2024, the Shanghai Stock Exchange (hereinafter referred to as ‘SSE’), taking into account China's national conditions, market characteristics and stage of development, compiled and released the ‘Three-Year Action Plan for Promoting the Improvement of the Quality of ESG Disclosure of Listed Companies in Shanghai (2024-2026)’ (hereinafter referred to as the ‘Action Plan’), which puts forward the general objectives, general principles and main actions of the programme for improving the quality of ESG disclosure of listed companies in Shanghai. (hereinafter referred to as the ‘Action Plan’), which puts forward the overall objectives, general principles and major actions of the programme to improve the quality of ESG disclosure of Shanghai listed companies, with the aim of promoting listed companies to improve their ESG governance level and guide listed companies to better practice the concept of sustainable development.

I. Core elements of the Programme of Action

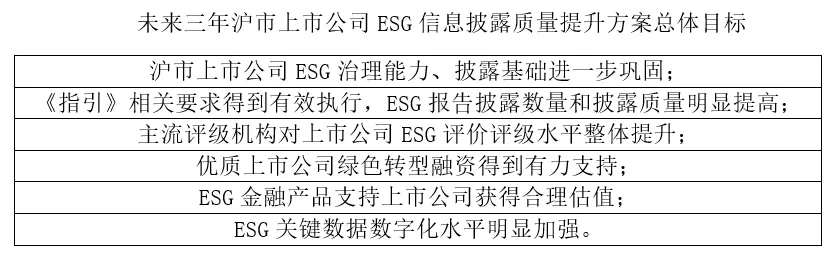

The Action Programme consists of four principles, six major areas and 17 specific work arrangements, forming a mutually supportive and reinforcing system. Through the work content published in the Action Programme, SSE strives to complete the following objectives within three years:

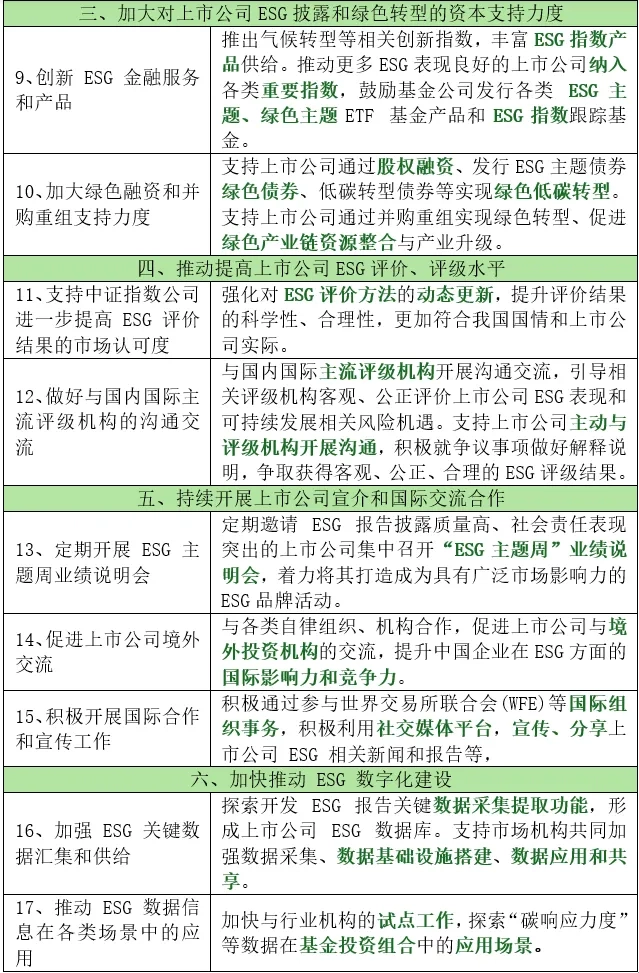

SSE adheres to the four principles of ‘seeking truth from facts, advancing prudently; cost-effectiveness, advocating mainly; classifying measures, rewarding and punishing equally; systematic thinking, gathering joint efforts’, and has formed 17 specific tasks from six aspects, namely, capacity building for information disclosure, information disclosure service and supervision, strengthening capital support, ESG evaluation and rating and investment, listed company promotion and international exchange and cooperation, and digital construction. The six major aspects of digital construction have resulted in 17 specific tasks, which are as follows:

II. Interpretation of the highlights of the Programme of Action

1. Introducing regulatory incentives and penalties

The Action Plan proposes a regulatory mechanism that emphasises both rewards and penalties. While rewarding outstanding companies, it increases the supervision of non-compliant companies. SSE will strengthen the supervision of companies' malicious selective disclosure, “bleaching green” and other initiatives. For companies that fail to disclose or disclose incomplete information as required, it will take corresponding self-regulatory measures to enhance the cost of their non-compliance. Meanwhile, the Action Programme proposes to take incentives for outstanding companies. SSE encourages companies to publish their characteristic practice results, and gives extra points to companies with high quality and high ratings of ESG reports in the appraisal of their information disclosure work, regularly invites companies with outstanding performance to hold performance briefing sessions, supports mainstream media to publicise outstanding cases, and promotes listed companies to carry out overseas exchanges and international cooperation.

2. Enriching the application of ESG financial scenarios

The Action Programme specifies the application of ESG financial products, which mainly involves the areas of equity financing, debt financing and innovative ESG financial products. In terms of equity financing, SSE supports the combination of green industry transformation and mergers and acquisitions (M&A), encourages business expansion by financing M&A, integrates the green industry chain, and realises industrial transformation and upgrading; at the same time, it encourages all kinds of financial institutions to incorporate ESG factors, and provides preferential financing facilities for listed companies with higher ESG ratings under the premise of controllable risks. In terms of bond financing, SSE supports companies to issue ESG-themed bonds, green bonds, low-carbon transformation bonds and other means of financing to help green and low-carbon transformation. In terms of innovation of ESG financial services and products, SSE encourages third-party organisations to launch ESG innovation indices and promote the inclusion of listed companies with good ESG performance in important indices; and encourages fund companies to issue ESG-themed ETF funds and ESG index funds to guide the flow of capital to the field of sustainable development.

3. Promoting digital construction and data application

While promoting green finance, the Action Programme also reinforces the support of digital tools to support the construction of digital management and reporting platforms for ESG data by enterprises. Through digital tools, enterprises can more efficiently collect, analyse and report ESG data to promote green and low-carbon transformation. At the same time, SSE promotes the application of ESG data information in various scenarios to provide reference for investors to carry out sustainable investment, laying a foundation for enhancing the value of ESG data usage.

4. Facilitating corporate value enhancement

The SSE encourages investors to discover corporate value and expand the scope of application of ESG information by improving the quality of ESG reports, and on 6 November, the SSE released a series of documents, including the "Self-Regulatory Guidelines for Listed Companies on the Shanghai Stock Exchange, No. 4 - Preparation of Sustainability Reports (Exposure Draft)" (hereinafter referred to as the Guidelines), to further explain and provide examples for reference.On 6 November, the SSE simultaneously released a series of documents including the "Self-Regulatory Guide No. 4 - Preparation of Sustainability Report (Exposure Draft)" (hereinafter referred to as the "Guide"), which further explain and provide examples for reference in respect of the assessment of materiality issues, the four elements of "governance - strategy - impact, risk and opportunity management - indicators and targets", etc., so as to facilitate the preparation of sustainability reports for listed companies; and to provide positive feedback to enterprises by promoting the discovery of the value of ESG reports, and to enable the company to greenBy promoting the value discovery of ESG reports, we will continue to provide positive feedback to enterprises so as to provide strong support for the financing of green transformation, improve the market value management system of listed companies, and help listed companies obtain a reasonable valuation.

III. Recommendations for listed companies

The release of the Action Plan highlights SSE's determination to actively promote the sustainable development of listed companies in Shanghai, and will play a positive role in promoting listed companies' awareness of ESG risk management, actively participating in ESG information disclosure, and continuously strengthening sustainable development management. In addition, by increasing positive publicity, enhancing the use value of ESG data, expanding the application scope of ESG ratings, effectively mobilising the enthusiasm of listed companies, encouraging listed companies to carry out overseas exchanges, and promoting the listed companies to devote themselves to the construction of sustainable development with stronger determination and motivation, so as to set up a model of sustainable development for other enterprises. Combined with the specific requirements of the Action Programme, CCXFGI puts forward the following suggestions to listed companies in Shanghai:

1. Enhance the quality of ESG data from a global perspective. CCXGFI suggests that listed companies improve the ESG report disclosure system, strictly control the quality of ESG information disclosure, strengthen ESG data management, and enhance the authenticity and credibility of data by actively carrying out ESG data validation and authentication. Grasp the window period of the Guidelines and proactively disclose high-quality ESG reports in response to regulatory requirements and stakeholder expectations.

2. Cooperate to build ESG management system. CCXGFI suggests listed companies to cooperate with various departments to build ESG management system, improve system construction, and incorporate ESG risk identification into the overall risk management system; strengthen ESG training to ensure that ESG strategic concepts are carried through all levels of decision-making and operation; and at the same time, promote ESG management of upstream and downstream industrial chain to create green supply chain, so as to comprehensively improve the company's ESG management level and performance performance. The company will also promote the ESG management of upstream and downstream industry chain to build a green supply chain, so as to comprehensively improve the ESG management level and performance of the company.

3. Systematic thinking and joint efforts to build ESG development ecology. CCXGFI suggests that listed companies obtain policy support and technical support through co-operation with the government, industry associations, rating agencies and other third-party organisations. With the auxiliary power of third-party organisations, we can improve the level of internal ESG control, actively communicate with international and domestic rating agencies, promote enhancement and development by rating, systematically improve ESG rating performance, enhance the influence of corporate sustainable development, and expand the application of multiple values of corporate ESG.

作者:丁美琳

审核:周美灵